Superintendence of the Securities Market of Panama enables receipt of digital documentation and online payments

March 26, 2020Relevant Aspects of Panama’s Tax Amnesty Extension

March 31, 2020The Ministry of Economy and Finance has promulgated Executive Decree No.251 of March 24, 2020, by which extraordinary tax measures are adopted in order to alleviate the economic impact that has occurred due to the State of Emergency in which the nation is located.

These measures are:

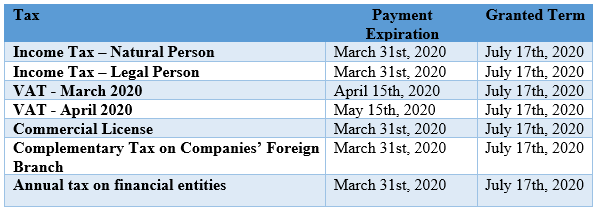

- A term of 120 calendar days (counted from the date of promulgation of Law No. 134 of March 17, 2020) is granted for the payment of taxes that must be paid during said period; and that are payable Panama’s Tax Authority, without this leading to the generation and payment of interest, surcharges and fines.

Exceptions are established to the term for the payment of taxes whose obligation arises from the quality of withholding agents, which we detail below.

- Income Tax withheld from employees

- Income Tax withheld from non-residents

- Value Added Tax withheld from non-residents

- Value Added Tax withheld by the State

- Value Added Tax withheld by local withholding agents

- Dividend tax

- Property Tax withheld by Banks

- Extension until May 30th, 2020 as a definitive term, for the presentation of the affidavit of income corresponding to the 2019 fiscal period of natural or legal persons. Eventually eliminating by virtue of the State of Emergency the extension of the period of one month for the presentation of the affidavit of income established in paragraph 5 of article 710 of the Tax Code.

- Taxpayers are given the facility to digitally present all original documents and / or authenticated copies as other documents that serve as evidence or requirements for procedures and applications before the Panama Tax Authority. This action will be carried out through the procedures that this entity establishes, including the request for the Non-application of the Alternate Calculation of Income Tax (CAIR) in accordance with the provisions of article 133-E.

- The Director of this entity during the term of the 120 calendar days, will be able to issue countersigned Good-standing certificates to taxpayers who present delinquency or inconsistencies in their current account, as long as they present at their office the corresponding request duly motivated and supported in accordance to the procedures established in this Decree. In this same way, during the same term, the presentation of good-standing certificates from Panama’s Tax Authrity and the Social Security Fund is exempt for all procedures carried out at these institutions.

- Taxpayers may determine for year 2020 the estimated tax according to their affidavit of income, which may total an amount that is not less than 70% of the tax caused in their tax returns for 2019 fiscal period, and this tax that must be paid in two periods during fiscal year 2020.

- a. Deadline for payment of the first period: September 30th, 2020

- b. Deadline for payment of the second period: December 31st, 2020

- Panama Tax Authority is is authorized, by means of a duly motivated and sustained resolution, to postpone the terms of presentation of the different tax compliance declarations and reports; without this entailing the generation and payment of fines.

- All those taxpayers who maintain processes for administrative tax evasion or criminal tax fraud will not be subject to the benefits established in this Decree.